mebel-kiev.site Gainers & Losers

Gainers & Losers

Installment Vs Revolving Credit

![]()

Installment loans offer structured repayment schedules for specific purposes, whereas revolving credit provides flexibility within a credit limit. In evaluating. Revolving credit refers primarily to credit cards and charge cards, where you have a monthly limit, but you choose how much you spend (and thus. In contrast to installment credit, revolving credit extends borrowers a line of credit with no determined end time, and they can spend up to their assigned. Revolving credit is a credit facility with a pre-approved credit limit determined by your affordability and creditworthiness. The nature of an installment account (fixed payments - reducing balances), FICO(r) knows that the balance will be relative to the payment. Installment credit: A type of credit that has a fixed number of payments. Revolving credit: Credit that is automatically renewed as debts are paid off. Revolving credit and installment credit are two basic types of credit. They differ in how borrowers use and repay them. There are some major differences between installment loans and revolving credit. For starters, installment loans come in one lump sum, but revolving credit. To maintain a good credit score, it's important to have both installment loans and revolving credit, but revolving credit tends to matter more than the other. Installment loans offer structured repayment schedules for specific purposes, whereas revolving credit provides flexibility within a credit limit. In evaluating. Revolving credit refers primarily to credit cards and charge cards, where you have a monthly limit, but you choose how much you spend (and thus. In contrast to installment credit, revolving credit extends borrowers a line of credit with no determined end time, and they can spend up to their assigned. Revolving credit is a credit facility with a pre-approved credit limit determined by your affordability and creditworthiness. The nature of an installment account (fixed payments - reducing balances), FICO(r) knows that the balance will be relative to the payment. Installment credit: A type of credit that has a fixed number of payments. Revolving credit: Credit that is automatically renewed as debts are paid off. Revolving credit and installment credit are two basic types of credit. They differ in how borrowers use and repay them. There are some major differences between installment loans and revolving credit. For starters, installment loans come in one lump sum, but revolving credit. To maintain a good credit score, it's important to have both installment loans and revolving credit, but revolving credit tends to matter more than the other.

Installment vs. Revolving Installment loans require the borrower to pay the amount borrowed in installments - daily, weekly, or monthly. The lender will. Revolving credit refers primarily to credit cards and charge cards, where you have a monthly limit, but you choose how much you spend (and thus. Installment loans are structured financial products where you borrow a fixed amount of money and repay it over a set period, typically with regular monthly. You'll notice a difference with repaying a revolving credit line compared to other loan types. The primary difference is you'll have more time to repay the. Installment credit options tend to come with lower interest rates compared to revolving loans. Because collateral is often involved, they're a lower risk. Installment loans are structured financial products where you borrow a fixed amount of money and repay it over a set period, typically with regular monthly. Installment credit is less open-ended than revolving credit. Installment credit is a loan that offers a borrower a fixed amount of money over a predetermined. Installment credit provides access to a fixed amount of funds that must be repaid in full over a predetermined period of time, while revolving credit gives. Even though revolving debts like credit cards usually have a minimum required payment, there is no penalty for paying back everything you borrowed against the. Revolving credit is a line of credit that allows you to borrow up to a certain limit, and then repay the debt over time. This type of credit usually has a lower. In contrast to installment credit, revolving credit extends borrowers a line of credit with no determined end time, and they can spend up to their assigned. Installment credit options tend to come with lower interest rates compared to revolving loans. Because collateral is often involved, they're a lower risk. Pros and Cons of Revolving Credit · Higher Interest Rates: Typically higher than installment loans, which can lead to higher overall costs if balances are not. Revolving lines of credit differ from installment loans because they give you access to a credit line that lets you borrow up to that amount multiple times on. The payments that you make on your installment loan are based on the principal balance, which is the original amount borrowed, as well as interest that has. When we compare installment vs. revolving credit, it's safe to say that installment credit is safer for your credit score than revolving credit. This article aims to provide a comprehensive guide on two fundamental types of credit—installment and revolving credit—demystifying their characteristics. Installment credit offers a lump sum loan amount that you borrow for a set period of time. · Revolving credit, on the other hand, is a line of credit you can. Installment loans provide a large sum upfront and offer predictability in the repayment process. Revolving credit is far more flexible in how you access and. How a revolving line of credit works is simple: you access funds up to a certain limit and only pay interest on the amount used. Unlike installment loans.

Learn To Build Websites Free

Weebly's free website builder makes it easy to create a website, blog, or online store. Find customizable templates, domains, and easy-to-use tools for any. Your no-code website builder Free and open source forever Learn web design standards Make professional websites Let's be a great community An alternative to. Many self-learners use free online resources, such as tutorials from W3Schools, MDN Web Docs, and YouTube channels. Practice through hands-on. w3schools is a free online learning platform dedicated to coding and web development. Of this list, this coding resource has been around maybe the longest so. Learn the basics of web development to build your own website. Includes HTML, CSS, Responsive Design, Flexbox, CSS Transitions, GitHub Pages, and more. Build a free, beautiful, mobile-friendly website without hiring help. Podia But you also need a place for your online courses. Your ebooks. Your. Ultimate web design course. From the fundamentals to advanced topics — learn how to build sites in Webflow and become the designer you always wanted to be. Yes, you can create a free website on platforms like mebel-kiev.site or mebel-kiev.site, but they are not entirely free. Here's why: You won't get your own domain name: You'. Create a professional website for free with the mebel-kiev.site website builder. Domain names, web hosting, website templates, and ecommerce solutions included. Weebly's free website builder makes it easy to create a website, blog, or online store. Find customizable templates, domains, and easy-to-use tools for any. Your no-code website builder Free and open source forever Learn web design standards Make professional websites Let's be a great community An alternative to. Many self-learners use free online resources, such as tutorials from W3Schools, MDN Web Docs, and YouTube channels. Practice through hands-on. w3schools is a free online learning platform dedicated to coding and web development. Of this list, this coding resource has been around maybe the longest so. Learn the basics of web development to build your own website. Includes HTML, CSS, Responsive Design, Flexbox, CSS Transitions, GitHub Pages, and more. Build a free, beautiful, mobile-friendly website without hiring help. Podia But you also need a place for your online courses. Your ebooks. Your. Ultimate web design course. From the fundamentals to advanced topics — learn how to build sites in Webflow and become the designer you always wanted to be. Yes, you can create a free website on platforms like mebel-kiev.site or mebel-kiev.site, but they are not entirely free. Here's why: You won't get your own domain name: You'. Create a professional website for free with the mebel-kiev.site website builder. Domain names, web hosting, website templates, and ecommerce solutions included.

Build a FREE website with GoDaddy's Website Builder. Mobile-friendly and modern templates. 24/7 customer support plus all the tools you need to succeed. Learn Web Development Essentials and Become a Web Developer From Scratch in this Complete HTML & CSS Beginner's Course. Learn To Build On Universe · Pricing And Plans · Sites Made On Universe · How To Build A Link In Bio Website For Free · Guides · Creator Interviews · Jobs. Build a free, beautiful, mobile-friendly website without hiring help. Podia But you also need a place for your online courses. Your ebooks. Your. Design and launch a professional, one-of-a-kind website in minutes with Canva's free website builder. Use free customizable templates, easy drag-and-drop tools. I would recommend starting with HTML, CSS, and JavaScript. These are the foundational languages for building websites, and there are plenty of great tutorials. All Hostinger hosting plans come with a free domain, simplifying hosting and domain management under one account. Leverage our domain name checker to browse all. StudioWeb is designed to allow teachers with no prior coding experience, to be able to teach a classroom with confidence. I can set up a free trial, so you can. Start building websites quickly and easily with no prior programming experience - Free Course. In this comprehensive guide, we'll explore how to use these tools to effortlessly create a fully functional website. For those eager to learn the fundamentals. Create your website and grow with confidence. From an intuitive website builder to advanced business solutions & powerful SEO tools—Try Wix for free. Learn how to make a website from scratch in 11 steps. From choosing a domain Try our AI website builder for free. example of building a website. online. Try FreshLearn for free Effortlessly create a course outline on any topic of your interest. Sign up for free. Freshlearn school. Why freshlearn. Create custom, responsive websites with the power of code — visually. Design and build your site with a flexible CMS and top-tier hosting. In this comprehensive guide, we'll explore how to use these tools to effortlessly create a fully functional website. For those eager to learn the fundamentals. Web Development courses · Full-Stack Engineer · Front-End Engineer · Back-End Engineer · Create a Back-End App with JavaScript · Build a Website with HTML, CSS, and. Filter by: · University of Michigan. Web Design for Everybody: Basics of Web Development & Coding · Johns Hopkins University. HTML, CSS, and Javascript for Web. Create a customizable, mobile-optimized website within the hour. All you need to start is a domain name and a vision for your website. If you're building a. In fact, there are many website builders, both free and paid like Mailchimp's free website builder and WordPress' site builder, that will allow you to design. Learn To Build On Universe · Pricing And Plans · Sites Made On Universe · How To Build A Link In Bio Website For Free · Guides · Creator Interviews · Jobs.

Target Credit Card Sign Up

Call us Target Credit Card & Target Mastercard (US): Target Mastercard (Outside US): Target Debit Card: Sign up for the Target REDcard today and let the savings begin. You'll get 5 I tend to shy away from savings offers that require me to get a credit card. The easiest way to apply for the Target Credit Card is online, and you can get to the online application by clicking the “Learn More” button on WalletHub. REDcard®: Target Debit Card, Target Credit Card, and Target® Visa® Credit Card. Subject to application approval (Target Visa Credit Card not available to new. Visit mebel-kiev.site to sign up or log into Manage my Circle Card. Was this information helpful? The latest on our store health and safety plans. Target has an additional $50 bonus for new card holders when you acquire your RedCard before December 9, There are more great cash back credit card. You can find the Target RedCard™ login at mebel-kiev.site The page will allow you to sign up for a Target RedCard™ or log in to manage your existing card. You can apply online at mebel-kiev.site or in-store at any Target location. To qualify for the best credit card offer, you'll generally need a credit score in the. Visit mebel-kiev.site to sign up or log into Manage my Circle Card. Do I need to activate or register my Visa debit card issued with my Target Circle™. Call us Target Credit Card & Target Mastercard (US): Target Mastercard (Outside US): Target Debit Card: Sign up for the Target REDcard today and let the savings begin. You'll get 5 I tend to shy away from savings offers that require me to get a credit card. The easiest way to apply for the Target Credit Card is online, and you can get to the online application by clicking the “Learn More” button on WalletHub. REDcard®: Target Debit Card, Target Credit Card, and Target® Visa® Credit Card. Subject to application approval (Target Visa Credit Card not available to new. Visit mebel-kiev.site to sign up or log into Manage my Circle Card. Was this information helpful? The latest on our store health and safety plans. Target has an additional $50 bonus for new card holders when you acquire your RedCard before December 9, There are more great cash back credit card. You can find the Target RedCard™ login at mebel-kiev.site The page will allow you to sign up for a Target RedCard™ or log in to manage your existing card. You can apply online at mebel-kiev.site or in-store at any Target location. To qualify for the best credit card offer, you'll generally need a credit score in the. Visit mebel-kiev.site to sign up or log into Manage my Circle Card. Do I need to activate or register my Visa debit card issued with my Target Circle™.

When I just searched here it says clerks are supposed to get people signed up for circle cards, is that different? The one I have is the debit. Sign Up below. Sign up to Manage Your Target Circle Card. Manage your card PIN The Target Circle Card credit cards (Target Credit Card and Target. My Limit Keeps Going Up! Credit Karma Member. I've had this card for a little more than a year and they've been steadily. You can transfer funds from your external checking or savings account by initiating a transfer from your bank account into your RedCard Account, setting up a. Information About Applying for a Credit Card: When you sign or otherwise submit a credit application, you are providing your consent and authorizing TD Bank USA. Get more of what you love with Target Circle Card Reloadable Account, including 5% off at Target¹, free shipping on most items on mebel-kiev.site², and free cash. Get a $50 off $50 Target discount; The card has no annual fee; 2/4/24 – 5/4/24 (HT DoC); OFFER LINK. Card Perks. You can also activate your card by calling and following the prompts. What can I do with a virtual temporary card. Your credit line will match your deposit ($ for $). calendar with a percent sign. Competitive Everyday Rate. With a rate of. You can apply for the Target Credit Card either online or in a Target store, at the customer service counter. You will need to have identification on you;. *5% Target CircleTM Card Discount: You will receive 5% off purchases paid for with your Target Circle Card (debit, credit, and reloadable) at Target stores. Log In. Account setup1/3. Personal details2/3. Review information3/3. Setting up Card can be used everywhere Visa® debit cards are accepted. Card is issued. card can sign up for a Mastercard Incorporated RedCard through TD Bank, USA. Target offers a RedCard credit card issued by TD Bank USA. The RedCard. Best Credit Card Sign-Up Bonuses · Best Credit Cards to Build Credit · Best Cardholders receive a coupon for 10% off a purchase every account anniversary year. Missing required parameter(s). Get top deals, latest trends, and more. Email address. Sign up Target Circle™Target Circle™ CardTarget Circle ™Target App. Apply for a Credit Card. Digital Banking Users. Use the Apply Now button below to log in for the. However, you can register your card with Target's Cartwheel app and use that to pay for a purchase at checkout. 8. Will the Target RedCard Credit Card help. Unlimited cash rewards · $ cash rewards welcome bonus · No annual fee · Introductory APR period for first 12 months · Access to Visa Signature® Concierge · Get up. Visit mebel-kiev.site to sign up or log into Manage my Circle Card. Was this information helpful? The latest on our store health and safety plans. Target Circle™ Card: Target Debit Card, Target Credit Card, Target Another sign up bonus from AAdvantage Aviator Red card if previous card was.

Reinstate Insurance Policy

During the grace period, you can reinstate your life insurance policy simply by paying the outstanding premium and any associated late fees. Grace periods. It depends on your policy history. How long has the policy been in force, how many late payments, returned payments, past cancel notices and. Reinstating a canceled policy is relatively simple and we allow our customers to reinstate their policies whenever possible. You should cancel your registration BEFORE canceling insurance coverage to avoid fines and penalties pursuant to Georgia law requiring insurance coverage. It is. Use this form to have your Death, Total and Permanent. Disablement (TPD) and/or Income Protection cover reinstated if your cover ceases due to. In the event a lapse has already occurred, some providers may also be able to reinstate your lapsed insurance if the policy has only been inactive for a few. Reinstatement fees for an insurance lapse range from $ to $ and fines ranging from $ to $1, are assessed on a tiered system based on the length of. If a license is reinstated after the license expiration date, all insurance company appointments are cancelled. The appointments are not required to reinstate. If your insurer agrees to reinstate your car insurance policy after it's been canceled, you will need to pay any outstanding premiums and other fees. You may. During the grace period, you can reinstate your life insurance policy simply by paying the outstanding premium and any associated late fees. Grace periods. It depends on your policy history. How long has the policy been in force, how many late payments, returned payments, past cancel notices and. Reinstating a canceled policy is relatively simple and we allow our customers to reinstate their policies whenever possible. You should cancel your registration BEFORE canceling insurance coverage to avoid fines and penalties pursuant to Georgia law requiring insurance coverage. It is. Use this form to have your Death, Total and Permanent. Disablement (TPD) and/or Income Protection cover reinstated if your cover ceases due to. In the event a lapse has already occurred, some providers may also be able to reinstate your lapsed insurance if the policy has only been inactive for a few. Reinstatement fees for an insurance lapse range from $ to $ and fines ranging from $ to $1, are assessed on a tiered system based on the length of. If a license is reinstated after the license expiration date, all insurance company appointments are cancelled. The appointments are not required to reinstate. If your insurer agrees to reinstate your car insurance policy after it's been canceled, you will need to pay any outstanding premiums and other fees. You may.

If you don't pay all owed premiums, you may lose your coverage dating back to the first month you missed the premium payment. You may also have to wait to get. PLEASE FOLLOW THE INSTRUCTIONS BELOW TO APPLY FOR REINSTATEMENT OF YOUR VETERANS' GROUP LIFE. INSURANCE (VGLI) COVERAGE. Application for Reinstatement of. You can revive your life insurance policy and reinstate policy benefits by following the necessary stipulated process such as payment of late payment charges. Can I get my coverage reinstated if it was cancelled or terminated? Generally, no. Unfortunately, federal regulations do not allow for us to reinstate your. To reinstate your driver license, you must pay the DMV a $50 license suspension termination fee. Do Not Drive Your Vehicle Without Insurance Coverage. If you do. You may also need to sign a no-loss statement. If your company won't reinstate your auto policy, you'll need to purchase a new one so you can get back on the. The law offices of Steven M. Dunn, PA has experience dealing with lapsed long term care insurance policies and can assist you with reinstatement. Normally, there is a "reinstatement" clause by which a life insurance policy that has lapsed (usually due to non-payment of premiums) can be reinstated. The. A lapse of coverage also occurs when insurance is terminated and no new policy information is received within 30 days of the termination date. There is no lapse. If a license is reinstated after the license expiration date, all insurance company appointments are cancelled. The appointments are not required to reinstate. You may also need to sign a no-loss statement. If your company won't reinstate your auto policy, you'll need to purchase a new one so you can get back on the. So, if your insurer cancels your coverage for any reason, you'll need to fix the problem quickly. A canceled policy means your auto insurance company has. In order to reinstate your health insurance plan, you must contact your health insurance provider. If your plan was terminated because of nonpayment, you may. Reinstating your lapsed auto insurance policy or obtaining a new one with a standard company doesn't mean you won't see an increase in your premium. For example. insurance and $14 reinstatement fee in order to reinstate your vehicle registration. Note that a DMV office or call center can't clear a registration. A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured files a claim. Reinstatement insurance refers to restoring a policy or coverage that has lapsed or been canceled, often by paying a reinstatement fee or making up missed. The policy reinstatement is the process of restoring an insurance policy back in effect after it has been previously terminated due to various reasons, most. If you don't pay your premium, your policy may lapse. To reinstate a lapsed policy, you may have to pay past due premium with interest. If you had a loan. Depending on the duration of the lapse — and the reason for the interruption — the insurance company might reinstate the policy. For example, if your policy has.

What Are The Best States To Retire In

Hawaii is considered to be the worst state to retire in. The annual spending for comfortable retirement in Hawaii is the highest of all 50 states at $, The five states that charge the highest combined (state and local) rates are Tennessee (%), Louisiana (%), Arkansas (%), Washington ( 9 Best States to Retire · 1. Alabama · 2. Delaware · 3. Florida · 4. Georgia · 5. Maryland · 6. New Jersey · 7. North Carolina · 8. Pennsylvania. Your Tennessee Consolidated Retirement System (TCRS) is recognized as one of the top 3 strongest pension funds in the United States by Standard & Poor's (S&P). Arizona Another Southwestern state tops our list as one of 's most popular destinations for retirees – Arizona. Like New Mexico, Arizona's climate and. You also can enroll in the State of Michigan (k) and Plans (the Plans) to help supplement your pension with additional retirement savings. ORS. Best and Worst States To Retire in , Ranked From Best to Worst · West Virginia is ranked number one based on cost factors and livability standards. · The. Right now mainly the ones with no income tax or don't tax pensions or Social Security. Florida, Tennessee, are the best bet. New Hampshire has. Florida is also a popular retirement spot due to its diverse lifestyles. The state offers everything from wildlife and beaches to major cities and theme parks. Hawaii is considered to be the worst state to retire in. The annual spending for comfortable retirement in Hawaii is the highest of all 50 states at $, The five states that charge the highest combined (state and local) rates are Tennessee (%), Louisiana (%), Arkansas (%), Washington ( 9 Best States to Retire · 1. Alabama · 2. Delaware · 3. Florida · 4. Georgia · 5. Maryland · 6. New Jersey · 7. North Carolina · 8. Pennsylvania. Your Tennessee Consolidated Retirement System (TCRS) is recognized as one of the top 3 strongest pension funds in the United States by Standard & Poor's (S&P). Arizona Another Southwestern state tops our list as one of 's most popular destinations for retirees – Arizona. Like New Mexico, Arizona's climate and. You also can enroll in the State of Michigan (k) and Plans (the Plans) to help supplement your pension with additional retirement savings. ORS. Best and Worst States To Retire in , Ranked From Best to Worst · West Virginia is ranked number one based on cost factors and livability standards. · The. Right now mainly the ones with no income tax or don't tax pensions or Social Security. Florida, Tennessee, are the best bet. New Hampshire has. Florida is also a popular retirement spot due to its diverse lifestyles. The state offers everything from wildlife and beaches to major cities and theme parks.

It's true that the reputation of the Golden State has been tarnished somewhat in recent years. Our marginal income tax rate is the highest in the nation for. If you want a safe retirement, be aware that Alaska has more than 7 times as much violent crime as Maine, and Louisiana has more than times as much property. When considering early retirement, it is important to understand that starting retirement An official website of the United States government. Here's how you. As a Plan 2 member of a Washington state retirement plan, you contribute The best part about this tool is that you can use it at any point in your. California, Florida, and Texas have the highest numbers of older adults. Wyoming, Delaware, and South Carolina have the most inbound movers citing retirement as. NYSTRS is one of the ten largest public pension funds in the U.S. providing retirement, disability and death benefits to eligible New York State teachers. Florida, Tennessee, are the best bet. New Hampshire has no income tax but property taxes are high and so is real estate. So there's not much. States such as Florida, Texas, and Nevada are popular choices due to their lack of state income tax and relatively low cost of living. Other options include. The Arizona State Retirement System (ASRS) has been selected as one of the Top Places to Work in Arizona for ! The recognition comes from Best Companies. Retirement income is fully taxed – with an exception for Social Security benefits – and the Golden State has the highest income tax nationally. High taxes. If you want a safe retirement, be aware that Alaska has more than 7 times as much violent crime as Maine, and Louisiana has more than times as much property. View Complete List · View Complete List · View Complete List · View Complete List · Fintech 50 · View Complete List · Best Places to Retire · View Complete. The best states for retirement include Florida, Alabama, Wyoming, Nevada, Tennessee, and Hawaii. These states rank highest when you consider factors like taxes. It is our goal to seek and secure the best investments and services for our If you are a member of an association, such as the Alabama Education Retirees. NYSTRS is one of the ten largest public pension funds in the U.S. providing retirement, disability and death benefits to eligible New York State teachers. For instance, states like Florida, Texas, and Nevada boast no state income tax, making them popular choices among retirees. But remember, it's not just about. The best state to retire in for taxes depends on your budget, lifestyle, and values. Find out more about factors retirees should weigh before relocating. An official website of the United States government. Here's how you know Which group best describes you? Select one, Federal Human Resources. Tulsa, Wichita, or Fayetteville (AR). Very low cost of living areas, good healthcare, and low tax burden. The Wisconsin Retirement System was created to protect public employees and their beneficiaries against the financial hardships of old age and disability.

Low Interest Collateral Loans

:max_bytes(150000):strip_icc()/what-difference-between-secured-and-unsecured-debts.asp-final-c2040f78625b44d98372ea024fa51697.png)

Secured loans typically offer lower interest rates than unsecured loans, making them attractive for creditworthy borrowers looking for an affordable way to. What are the benefits of a secured loan? These loans include benefits like: Covering costs with fast cash; Enjoy competitive interest rates and low monthly. We researched and evaluated loan amounts, APRs, fees, terms and more of the best secured personal loan lenders. Here are the five that topped the list. Access our lowest rates available With an average APR discount of 20% compared to our unsecured loan*, homeowners can save more with secured. No impact to. Share Certificate-Secured Loan Use your share-certificate savings account balance to secure funds immediately with a low interest rate. Borrow up to 80% of. What is an Unsecured Personal Loan? A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. The lender has the right to seize the collateral if you can't repay the loan. Collateral loans often come with lower interest rates or larger loan amounts. Generally, secured loans are easier to qualify for than unsecured loans. Plus, they often come with lower annual percentage rates (APRs) and higher loan amounts. You are billed quarterly for interest only. · The interest rate is % over the interest rate of the savings or CD account being used to secure the loan. Secured loans typically offer lower interest rates than unsecured loans, making them attractive for creditworthy borrowers looking for an affordable way to. What are the benefits of a secured loan? These loans include benefits like: Covering costs with fast cash; Enjoy competitive interest rates and low monthly. We researched and evaluated loan amounts, APRs, fees, terms and more of the best secured personal loan lenders. Here are the five that topped the list. Access our lowest rates available With an average APR discount of 20% compared to our unsecured loan*, homeowners can save more with secured. No impact to. Share Certificate-Secured Loan Use your share-certificate savings account balance to secure funds immediately with a low interest rate. Borrow up to 80% of. What is an Unsecured Personal Loan? A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. The lender has the right to seize the collateral if you can't repay the loan. Collateral loans often come with lower interest rates or larger loan amounts. Generally, secured loans are easier to qualify for than unsecured loans. Plus, they often come with lower annual percentage rates (APRs) and higher loan amounts. You are billed quarterly for interest only. · The interest rate is % over the interest rate of the savings or CD account being used to secure the loan.

Personal Secured Loans ; *The annual percentage rate (APR) is the prime rate as indicated in the Wall Street Journal plus 2%. As of 6/16/, the prime rate is. Savings Secured Loan. Secure financing without dipping into your savings, and at a lower rate. Features: Fully secured by your Navy Federal savings account. Our Share Secured loans offer many advantages, including: The ability to help build or repair your credit history. Low variable rates1: (prevailing share or. With an unsecured personal loan, you can get low, fixed-rate financing for amounts up to $50, and affordable monthly payments. No collateral is required. Simply secure your loan against a TSB Hometown Savings account or CD, and you can borrow up to 90% of the account balance, at a rate of just 3% above the rate. Share-Secured Loans: Normal credit criteria apply. Rates for approved loans are based on the applicant's credit history. Stated “as low as % APR” apply to. Get more money by using your car title to secure a loan. Fixed, affordable payments available. Prequal won't affect your credit score. loans with low cost that uses real estate as collateral. Apply for collateral Collateral Business Loans. Collateral business loans may offer lower rates. Secured loans may allow borrowers to enjoy lower interest rates, as they present a lower risk to lenders. However, certain types of secured loans—including bad. Certificate-Secured Loan Rates Loan rates for Certificate-Secured loans are % over the certificate dividend rate or the same certificate's current offered. Securing a loan with collateral gives you more borrowing power and a lower interest rate — even if you have less-than-perfect credit. A collateral loan is an. Eligible investments serve as collateral, offering a lower interest rate than would be charged on an unsecured line of credit. Secured loans may also offer lower interest rates for borrowers compared to unsecured loans since there's collateral backing up the debt. With unsecured. Borrow against the value of your savings at a low rate while your savings continue to grow uninterrupted. Avoid early CD withdrawal penalties. An unsecured personal loan is a type of loan that allows borrowers to access funds without the need to provide collateral. Unlike secured loans where the. interest rates range from % to %. The most credit worthy applicants may qualify for a lower rate while longer-term loans may have higher rates. The. Finance a big purchase or consolidate high-interest debt with a cash-secured To qualify for the lowest APR available: 1) the term of the loan must be. Consolidation loans can reduce your monthly payments or lower your interest rate compared to your current debts. Rates for savings and certificate secured. Secured or unsecured: Secured loans are backed by your collateral either by property or investments, resulting in a higher borrowing amount and lower interest. credit. Lower interest rates than unsecured loans: Lenders often offer lower interest rates and fees on collateral loans than unsecured loans due to the.

Sock Subscription Shark Tank

Foot Cardigan. likes. As seen on ABC's Shark Tank. Fantastically fantastic socks delivered to your mailbox every month sock-subscription-box. Our patented Air Pocket technology adds an extra layer of cushioning between the sock and sole for unparalleled comfort. WATER-FRIENDLY: Dive into fun. Gift that keeps on giving every single month · High quality combed cotton socks · Fun styles included in each shipment · Prepaid plans so you never get billed. Discover our range of crazy socks and colorful socks that add a pop of fun to any outfit. Perfect for gifting or personal style upgrades. Our moisture-wicking Shark Attack Socrates® athletic socks have a cushioned and contoured sole to keep your feet comfortable and dry during any activity. See how punchy groomsmen socks add panache to attire. Bright-colored stripes and polka dots add character to the best man's ensemble. Sock Club – Quality and care in every pair. The highest quality monthly sock subscription. Free shipping. Include a personal message for your loved ones. SUBSCRIPTION BOXES /SOCK · Facebook Icon Twitter Icon Reddit Icon Pintrest Icon Email Icon 15 Best Subscription Boxes Pitched on Shark Tank. By Geraldine. Foot Cardigan was on Shark Tank season 7. Sock subscription club delivers fun and fashionable women's, men's, and kid's socks monthly. Foot Cardigan. likes. As seen on ABC's Shark Tank. Fantastically fantastic socks delivered to your mailbox every month sock-subscription-box. Our patented Air Pocket technology adds an extra layer of cushioning between the sock and sole for unparalleled comfort. WATER-FRIENDLY: Dive into fun. Gift that keeps on giving every single month · High quality combed cotton socks · Fun styles included in each shipment · Prepaid plans so you never get billed. Discover our range of crazy socks and colorful socks that add a pop of fun to any outfit. Perfect for gifting or personal style upgrades. Our moisture-wicking Shark Attack Socrates® athletic socks have a cushioned and contoured sole to keep your feet comfortable and dry during any activity. See how punchy groomsmen socks add panache to attire. Bright-colored stripes and polka dots add character to the best man's ensemble. Sock Club – Quality and care in every pair. The highest quality monthly sock subscription. Free shipping. Include a personal message for your loved ones. SUBSCRIPTION BOXES /SOCK · Facebook Icon Twitter Icon Reddit Icon Pintrest Icon Email Icon 15 Best Subscription Boxes Pitched on Shark Tank. By Geraldine. Foot Cardigan was on Shark Tank season 7. Sock subscription club delivers fun and fashionable women's, men's, and kid's socks monthly.

club like they owned the place. Upvote 2. Downvote Reply reply. Award Pretty sure I saw this idea on shark tank, some kids danced around. The Magic Science of Compression: Turning Footwear into a Healing Tool · FROM INNOVATING SUSTAINABLE, GAME-CHANGING SOCKS TO A SHARK TANK TRIUMPH, EXPLORE. This time a year ago Foot Cardigan premiered on Shark Tank and wowed America with their fantastically fantastic sock of the month club! Buy Fun Sock Subscription Box by Foot Cardigan - As Seen on Shark Tank - Sock of the Month Club Includes 1 Pair of Men's Socks a Month Makes a Great Gift. HIGH QUALITY: Your men's subscription box socks will be made from high-quality combed cotton, knitted with needles, and offer extra arch support. From standard dress socks to specialty socks; we have everything in between. Most sock styles can have a max of 6 colors too! And we have FREE pms color. 22 votes, 71 comments. A couple from Everett, Washington, claim to have finally solved the mystery of the missing baby sock. Plus, we have our Sock of the Month Club. And, we have gift boxes and gift bags. We focus on socks and seek to offer packages that will spread happiness. Shop Fun Sock Subscription Box by Foot Cardigan - As Seen on Shark Tank - Sock of the Month Club Includes 1 Pair of Men's Socks a Month Makes a Great Gift. Find helpful customer reviews and review ratings for Fun Sock Subscription Box by Foot Cardigan - As Seen on Shark Tank - Sock of the Month Club Includes 1. Sockodiles · Customer Reviews · Subscriptions · Account · Resources · Company · Follow us. Finally, socks that stay on. Squid Socks vs Shark Tank. Will our socks withstand the Lori pull test? This No Middleman favorite appeared on Shark Tank and received offers from Mark Cuban and Troy Carter for their subscription-based and ala carte sock business. As seen on ABC's Shark Tank, this fun Sock Subscription was one of the first to launch back in They have long been known for the really fun and quirky. Followers, Following, Posts - Foot Cardigan (@FootCardigan) on Instagram: "As seen on Shark Tank Home of the O.G. sock subscription. Throx Salmon & Ocean Blue Thigh Highs THE CURE FOR THE MISSING SOCK! AS SEEN ON SHARK TANK! Bombas is a comfort focused sock and apparel brand with a mission to help those in need. One purchased = one donated, always and forever. As seen on ABC's Shark Tank. Website: https POV: you open your sock of the month club subscription and are surprised with a delightful throwback design. Length: No Show | LoaferSize: Men | Free Size With Stretch Spandex Washcare: Machine washable Why should you buy these socks? Anti-Slip Silicone Grips: Our.

What Bank Is Moneylion On Plaid

To link your Cash App account to another service, you can use the account and routing numbers that are listed in your Banking tab. Why do I have to connect my bank account? Credit Genie uses Plaid to connect your bank account and verify your information. This helps us determine eligibility. Pathward and MoneyLion first joined forces in , and the most notable product born from the partnership is RoarMoneySM, a Demand Deposit Account offered. Apps like Cash App or MoneyLion offer the option to use Plaid, though it is not required. If you're wondering whether your bank uses Plaid. MoneyLion. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. Chime. Grow. Plaid in San Francisco offers a suite of applications supporting banks with risk management and customer account management features. Plaid is used by. Plaid's technology provides connections to more than US banks and credit unions. Learn how we power the apps in your financial life. Fintech Funding: Tough attributed to 'cautious' VCs, high interest rates · Mastercard touts security of new account-opening solution · As Plaid network. MoneyLion is a financial technology company, not a bank. RoarMoney℠ demand deposit account provided by, and MoneyLion Debit Mastercard®️ issued by, Pathward®️. To link your Cash App account to another service, you can use the account and routing numbers that are listed in your Banking tab. Why do I have to connect my bank account? Credit Genie uses Plaid to connect your bank account and verify your information. This helps us determine eligibility. Pathward and MoneyLion first joined forces in , and the most notable product born from the partnership is RoarMoneySM, a Demand Deposit Account offered. Apps like Cash App or MoneyLion offer the option to use Plaid, though it is not required. If you're wondering whether your bank uses Plaid. MoneyLion. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. Chime. Grow. Plaid in San Francisco offers a suite of applications supporting banks with risk management and customer account management features. Plaid is used by. Plaid's technology provides connections to more than US banks and credit unions. Learn how we power the apps in your financial life. Fintech Funding: Tough attributed to 'cautious' VCs, high interest rates · Mastercard touts security of new account-opening solution · As Plaid network. MoneyLion is a financial technology company, not a bank. RoarMoney℠ demand deposit account provided by, and MoneyLion Debit Mastercard®️ issued by, Pathward®️.

TD Bank and Plaid Partner to Ease Access to Apps. December 14, | Digital MoneyLion said it recorded rising revenue this quarter after developing new. Payoneer, Robinhood, MoneyLion: Q2 highlights & what's next on their radar? We delve into the recent earnings and future direction of Payoneer, Robinhood, and. Plaid's platform authenticates user bank accounts and securely connects them with apps, moving money with ease. MoneyLion now supports linking your RoarMoney account to other financial applications through Plaid MoneyLion is a financial technology company, not a bank. MoneyLion is a financial technology company, not a bank. RoarMoney℠ demand deposit account provided by, and MoneyLion Debit Mastercard®️ issued by, Pathward®️. Pathward®, N.A. (“Bank” or “Pathward”), announced the Bank and MoneyLion (NYSE: ML), a digital ecosystem for consumer finance, have committed to an additional. You can link external bank accounts, or Funding Sources to Select your bank from the list of options or use the search bar to find one. We use Plaid. MoneyLion is a financial technology company, not a bank. RoarMoney℠ demand deposit account provided by, and MoneyLion Debit Mastercard®️ issued by. First Columbia Bank & Trust Co. Coastal Community Bank (WA) - Online Banking. Gorham Savings Bank. Woodlands Bank (PA). Open the Current app and connect it to your MoneyLion account using Plaid. Follow these steps to transfer the money: Tap “Transfer” on the. Make better money decisions with MoneyLion. Access mobile banking, personal finance resources, fast cash advances & cashback rewards for extra money when. Cash App uses Lincoln Savings Bank to connect with Plaid. Does Plaid Support Cash App? Yes, Plaid supports Cash App. Plaid is a service that offers a safer way. Bank of America - Money Network; Branch; mebel-kiev.site - Premium Bank Account; Chime*; Credit Karma; Current; Dave; GO2bank; Green Dot Prepaid Debit Card; Jelli. MoneyLion is a financial technology company, not a bank. RoarMoney℠ demand deposit account provided by, and MoneyLion Debit Mastercard®️ issued by. Where Else Is Plaid Used? · Mobile banking: Varo, Chime, M1 Finance, and MoneyLion · Saving and investing: Acorns, Digit, Qapital, and Ellevest · Personal finance. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. We use Plaid, a third-party data provider, to link external accounts to Empower. If you aren't able to find your bank in the search function, that means. Some well-known clients and banks that work with Plaid include Venmo, Transferwise, MoneyLion, Upstart, Acorns, Robinhood, and Betterment. #2 MX. MX has. Do you agree with MoneyLion's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out. Bank Omaha; First Savings Bank; First Tech Federal Credit Union; FirstBrick Money Managers Inc. Money Positive; Money Professionals; mebel-kiev.site; MoneyComb.

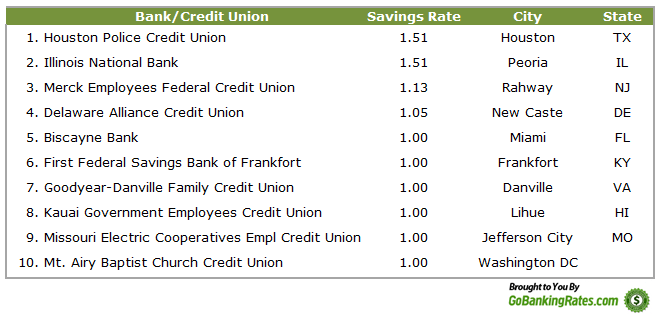

What Bank Has The Highest Savings Interest

PNC High Yield Savings · Achieve more with a higher interest · Features & Benefits · Online & Mobile Banking · Ready to Start Saving? Interest Rate, unless the Bank has notified you otherwise. The Bank may limit the amount you may deposit in this product to an aggregate of $ million. 3. Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Open a savings account with First Hawaiian Bank, the best bank The perfect complement to your personal Checking account. Earn higher interest rates with. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Personal Account Acts like chequing, earns like savings—with % interest (Footnote). The best features of a chequing account—plus % interest (Footnote). Best Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · %. PNC High Yield Savings · Achieve more with a higher interest · Features & Benefits · Online & Mobile Banking · Ready to Start Saving? Interest Rate, unless the Bank has notified you otherwise. The Bank may limit the amount you may deposit in this product to an aggregate of $ million. 3. Our picks at a glance ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ ; LendingClub Bank High-Yield Savings. Up to. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Open a savings account with First Hawaiian Bank, the best bank The perfect complement to your personal Checking account. Earn higher interest rates with. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Personal Account Acts like chequing, earns like savings—with % interest (Footnote). The best features of a chequing account—plus % interest (Footnote). Best Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · %.

With a % APY and a low minimum opening deposit of $, Evergreen Bank Group's high-yield savings account is accessible and affordable. You can sign up for. interest savings accounts with no promos and no minimum, Motive Financial. They offer %. They are an arm of Canadian Western Bank. Upvote. Aside from their higher interest rates, high-yield savings accounts can sometimes come with a few other differences. Typically, high-yield savings account rates. Start saving with a Varo Bank Savings Account and qualify for up to % APY on up to $5k. With Varo Bank, you get everything you need to reach your savings. TAB Bank offers a high-yield savings account with % APY—more than 11 times the national average. You only need $ on deposit to earn this rate and there. Maximize your earnings with one of our CDs. You pick the time frame and invest as little as $1, and we'll pay you a fixed interest rate on your money. Which. Earn more than 9x the national average · EverBank %. apy · National average % · Bank of America % · Wells Fargo %. Bank account interest rates increase your funds with a steady return. Find out today's CD, checking and savings account rates from Bank of America. A savings account with high interest offered through Raisin is a great Which bank has the best savings account? What are the best savings account. Save Your Hard-Earned Cash With A First Bank High Yield Savings Account · 6 free withdrawals per month* · Interest-earning account access · $1, minimum required. With a % APY and a low minimum opening deposit of $, Evergreen Bank Group's high-yield savings account is accessible and affordable. You can sign up for. deposit with them, meaning a paycheck or government check of some sort. No thanks. Here's a short list of good online banks with >5% APY. A High Interest Savings Account (HISA) lets you earn a higher interest rate on your balance, while always having your money available. I did a quick search, and the two highest I found were My Banking Direct and Flagstar Bank, both of which have an APY of %. The interest in some HYSAs compounds daily, with others it's monthly. HYSAs are usually offered by online institutions, not brick-and-mortar banks. If you're. You have larger balances and want to earn up to our highest rates. Interest rates. Your rate grows with your balance. Find a branch to learn about rate. Put your savings to work with a Gate City Bank high yield savings account, offering our best interest rates with no monthly fees. Here's a closer look! High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ savings accounts opened with major banks, and coverage is free and automatic. Availability. The longer you leave your money in savings, the greater the. A savings account with high interest offered through Raisin is a great Which bank has the best savings account? What are the best savings account.

Va Interest Rates 30 Year Fixed

$, mortgage for 30 years at % (% APR) will result in a monthly payment of $1, Taxes and insurance not included; therefore the actual payment. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. Today's year fixed VA refinance loan rate stands at %. See more rates, including assumptions, in the table below. year fixed VA ; year fixed VA, %, % ; Rates are provided by our partner network, and may not reflect the market. Your rate might be different. Refinance · VA Loans. Home Equity. Home Equity Loans · HELOC · Cash-out Refinance. yr fixed VA. Rate. %. APR. %. Points (cost). ($3,). Term. 30 Year Mortgage Rate in the United States remained unchanged at percent in September 4 from percent in the previous week. This page includes a. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed-Rate VA. Year Fixed Rate. Interest%; APR%. More details for Year. APR rates for year loans are offered as low as %, while the year loan APR is offered as low as %. Compare 5 Best VA Loan Rates of Lender. VA loan rates for September 9, ; year fixed VA, %, % ; Rates are provided by our partner network, and may not reflect the market. Your rate. $, mortgage for 30 years at % (% APR) will result in a monthly payment of $1, Taxes and insurance not included; therefore the actual payment. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. Today's year fixed VA refinance loan rate stands at %. See more rates, including assumptions, in the table below. year fixed VA ; year fixed VA, %, % ; Rates are provided by our partner network, and may not reflect the market. Your rate might be different. Refinance · VA Loans. Home Equity. Home Equity Loans · HELOC · Cash-out Refinance. yr fixed VA. Rate. %. APR. %. Points (cost). ($3,). Term. 30 Year Mortgage Rate in the United States remained unchanged at percent in September 4 from percent in the previous week. This page includes a. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed-Rate VA. Year Fixed Rate. Interest%; APR%. More details for Year. APR rates for year loans are offered as low as %, while the year loan APR is offered as low as %. Compare 5 Best VA Loan Rates of Lender. VA loan rates for September 9, ; year fixed VA, %, % ; Rates are provided by our partner network, and may not reflect the market. Your rate.

For today, Tuesday, September 10, , the current average interest rate for the benchmark year fixed mortgage is %, falling 7 basis points since the. Get the latest mortgage rates for 30 year fixed VA purchase or refinance from reputable lenders at mebel-kiev.site®. Simply enter your home location, property. VA loans: The annual percentage rate (APR) calculation assumes a $, fixed-term loan ($, base amount plus $6, VA funding fee) with no borrower. Compare the 30 year fixed VA mortgage rates & estimate the VA loan amount & monthly mortgage payment with taxes & insurance with the VA mortgage calculator. Find average mortgage rates for the 30 year VA fixed mortgage from Mortgage News Daily rate survey. The average Virginia rate for a fixed year mortgage is % (Zillow, Jan. ). Virginia Jumbo Loan Rates. The conforming loan limits throughout the state. Interest rates as low as %* *APR based on a $K sales price, 10% down payment, financing the VA funding fee under the CalVet/VA loan program, and one-. Today's Rate on a VA Year Fixed Mortgage Is % and APR % Since VA loans are guaranteed by the government, VA loans provide access to special. VA Loans are government-backed mortgages that offer highly competitive interest rates, with little to no down payment required. Apply To Prequalify · Learn About Jumbo Loans. Year VA. Rate%. /. APR%. Points. (). What are APR and points? Apply To Prequalify · Learn About VA Loans. We. A year VA mortgage is a home loan with a year term that can have a down payment as little as 0% depending on the applicant's qualifications. It is. Today's Rate on a VA Year Fixed Mortgage Is % and APR % Since VA loans are guaranteed by the government, VA loans provide access to special. National year fixed VA mortgage rates go down to %. The current average year fixed VA mortgage rate fell 4 basis points from % to % on. VA Loan. % Interest rateSee note1; % APRSee note2. year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year Fixed-Rate VA Loan: An. Graph and download economic data for Year Fixed Rate Veterans Affairs Mortgage Index (OBMMIVA30YF) from to about veterans, year. Mortgage Rates Today ; Product: 15 Year Fixed Rate, Resources: Calculate, Rate: %, APR*: %. 15 Year Fixed Rate × ; Product: VA 30 Year Fixed Rate. For instance, year fixed VA rates currently have interest rates hovering somewhere around %–% and annual percentage rates (APRs) between %–%. For example, in March , a typical year fixed mortgage (national) would come with an interest rate of %. In that same month, a VA loan on the same Year Fixed · % · % APR ; Year Fixed · % · % APR ; Year Jumbo · % · % APR ; Year FHA · % · % APR ; Year VA · %.