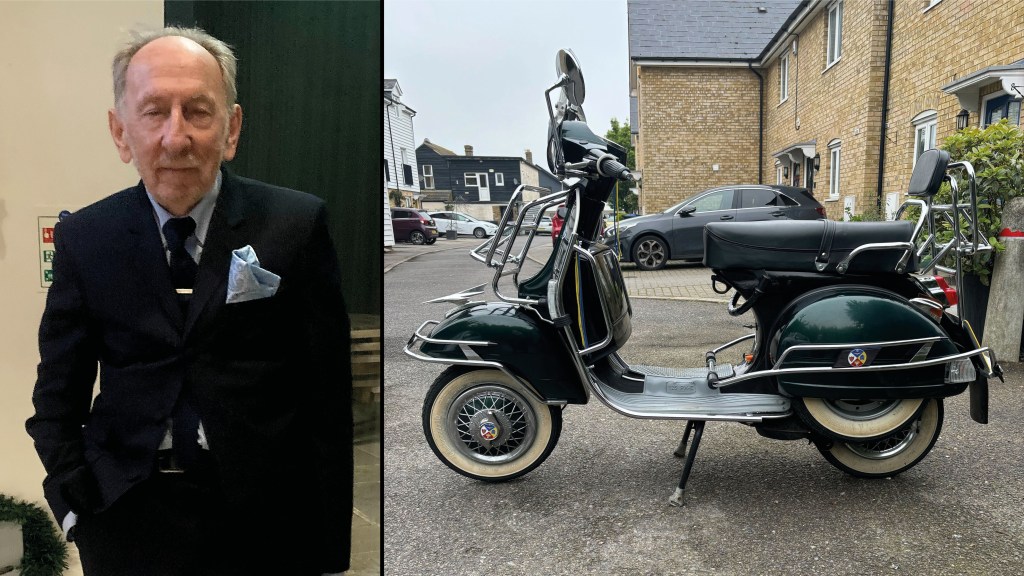

Elderly Scooter Enthusiast Sells Vespa Due to Insurance Challenges

Owen Herring, an 82-year-old retired BT manager residing in Whitstable, Kent, encountered significant difficulties in securing insurance for his Vespa this past May after Hastings declined to renew his policy.

Since 1959, Herring has been passionate about scooters, owning a PX150 and a GT60. He typically paid around £150 for third-party insurance for each vehicle, which included coverage for fire, theft, and potential damage to other vehicles.

On May 25, Hastings provided a renewal quote of £178 for his GT60 but indicated it would not insure his PX150. The company cited factors like the increased claim risk associated with certain vehicle types and geographic areas.

Due to the inability to find alternate insurance options, Herring was forced to sell his cherished Vespa. “I think it’s an age thing,” he remarked, expressing concern about potential issues insuring his car when it’s up for renewal at Christmas, as well as his other scooter next year.

According to Hastings, the insurance policy for Herring’s PX150 had an upper age limit of 83, which could explain the inability to offer a renewal. Meanwhile, the GT60 had a higher maximum age limit of 87.

Many insurers are distancing themselves from higher-risk customers amid a surge in claims. A survey conducted by Compare the Market indicated that 31% of drivers in 2023 were not offered renewals when their policies lapsed over the previous year.

Mohammad Khan from PwC UK noted, “A sustained rise in supply chain costs for car repairs and personal injuries has prompted many insurers to reassess the risks they are willing to underwrite. This has led to tighter policies this year.”

It’s customary for a renewal quote to arrive 21 to 30 days before policy expiration, detailing last year’s payment amount along with the new cost, typically higher.

As reported by the Association of British Insurers (ABI), the average comprehensive car policy reached £622 in the second quarter, showcasing a 21% increase from the same timeframe the previous year. James Daley from Fairer Finance remarked that it’s “definitely plausible” that more drivers are experiencing non-renewals due to insurers’ decreased risk appetite, as they aim to retain more lucrative customers while avoiding those likely to incur costs.

Common reasons for non-renewal include upticks in local car accidents, thefts, and rising theft rates among specific vehicle types. The ABI observed a 39% rise in average claim payouts, escalating from £3,414 in 2019 to £4,760 in the first half of this year. Moreover, the consultancy EY labeled last year the most challenging for motor insurers since 2011, as payouts exceeded premiums collected by 112.8%, up from 111.1% in 2022. This marked the second consecutive year of losses for motor insurers.

Increasing costs for insurers generally lead to elevated premiums for drivers; however, sometimes price hikes fall short of covering expenses.

Ian Hughes from Consumer Intelligence stated, “Insurance companies must frequently analyze their claims data and adapt their risk strategies accordingly. This can inadvertently cause some drivers to face re-evaluations of their premiums or even affect their coverage eligibility.”

Driver Denied Coverage After Seeking Better Quotes

When Loc Bui reached out to his car insurer regarding a cheaper deal, he was met with a refusal for any insurance coverage.

Bui, a chef from Addingham in West Yorkshire, received a renewal quote of £349 for his 2009 BMW 1 Series before the policy’s end on July 27. With a drop in his annual mileage from about 16,000 to just 2,500 miles, he anticipated securing a better offer after checking comparison sites.

His lowest quote was £250 from Hastings Direct. However, after updating his information with Dial Direct and requesting them to match the quote, he learned that they would not cover him at all. “There was no explanation,” said Bui, 49. “Logically, I should be at a lower risk now. It seems beneficial for any insurer.”

Dial Direct later attributed the inability to offer a renewal quote to a “system issue” with their underwriter, explaining that they eventually found another underwriter, but Bui had already accepted a quote elsewhere.

The company clarified that his policy was canceled due to outdated mileage information, asserting that Bui was never presented with another renewal option.

Meanwhile, owners of high-performance SUVs, like Range Rovers, are facing greater challenges in obtaining insurance, with premiums sometimes soaring into tens of thousands of pounds due to theft rates.

Signs of improvement are emerging, however, as the ABI noted that average motor payouts increased by only 0.5% between the first and second quarters of this year, while comprehensive car premiums decreased by 2%, despite remaining significantly higher than the previous year. EY also projected a potential return to profitability for motor insurers this year.

The ABI stated, “While insurers regularly evaluate their risk appetites, the motor insurance market remains competitive. Coverage options are available from numerous providers, offering a range of products to cater to customer needs.”

For those struggling to find insurance, consider reaching out to the British Insurance Brokers’ Association at 03709 501970 for assistance in locating a broker.

Post Comment